Why Continuing Professional Education Matters Today

- Леонид Ложкарев

- Jan 19

- 7 min read

Updated: Jan 20

Meeting ongoing learning requirements can feel overwhelming for busy internal auditors and compliance officers in the American financial sector. Staying current with regulatory changes and technological advancements matters because professional credentials rely on continuous education. With expanded virtual learning options and updated standards approved by organizations like PCAOB and AICPA, finding targeted CPE courses has never been more accessible. This overview highlights how structured CPE pathways support career advancement while ensuring ongoing competence and compliance.

Table of Contents

Key Takeaways

Point | Details |

Importance of CPE | Continuing Professional Education is essential for maintaining professional certifications and staying updated with industry standards. |

Diverse Learning Formats | CPE can be obtained through various methods, including online courses, webinars, and professional workshops, accommodating different learning styles. |

Regulatory Compliance | Professionals must meet specific CPE requirements set by regulatory bodies to maintain credentials and avoid penalties. |

Career Advancement | Engaging in CPE not only fulfills certification requirements but also enhances career prospects through skill development and networking opportunities. |

Defining Continuing Professional Education Requirements

Continuing Professional Education (CPE) represents a structured approach to lifelong learning that enables professionals to maintain and enhance their skills throughout their careers. Regulatory frameworks globally emphasize the critical importance of ongoing professional development beyond initial certification or degree programs.

At its core, CPE involves systematic learning activities designed to help professionals stay current with evolving industry standards, technological advancements, and regulatory changes. These requirements are typically mandated by professional associations, licensing boards, and regulatory agencies to ensure practitioners demonstrate ongoing competence. Professional credentials like CPA, CIA, and CFE often require specific CPE credit hours annually to maintain active status.

The scope of CPE extends far beyond traditional classroom training. Professionals can earn credits through diverse learning modalities including online courses, webinars, conferences, professional workshops, publishing research, presenting at industry events, and even structured self-directed learning. Interactive CPD methods have proven particularly effective in helping practitioners update their knowledge and skills.

Pro tip: Track your CPE credits meticulously throughout the year and maintain comprehensive documentation to streamline annual certification renewal processes.

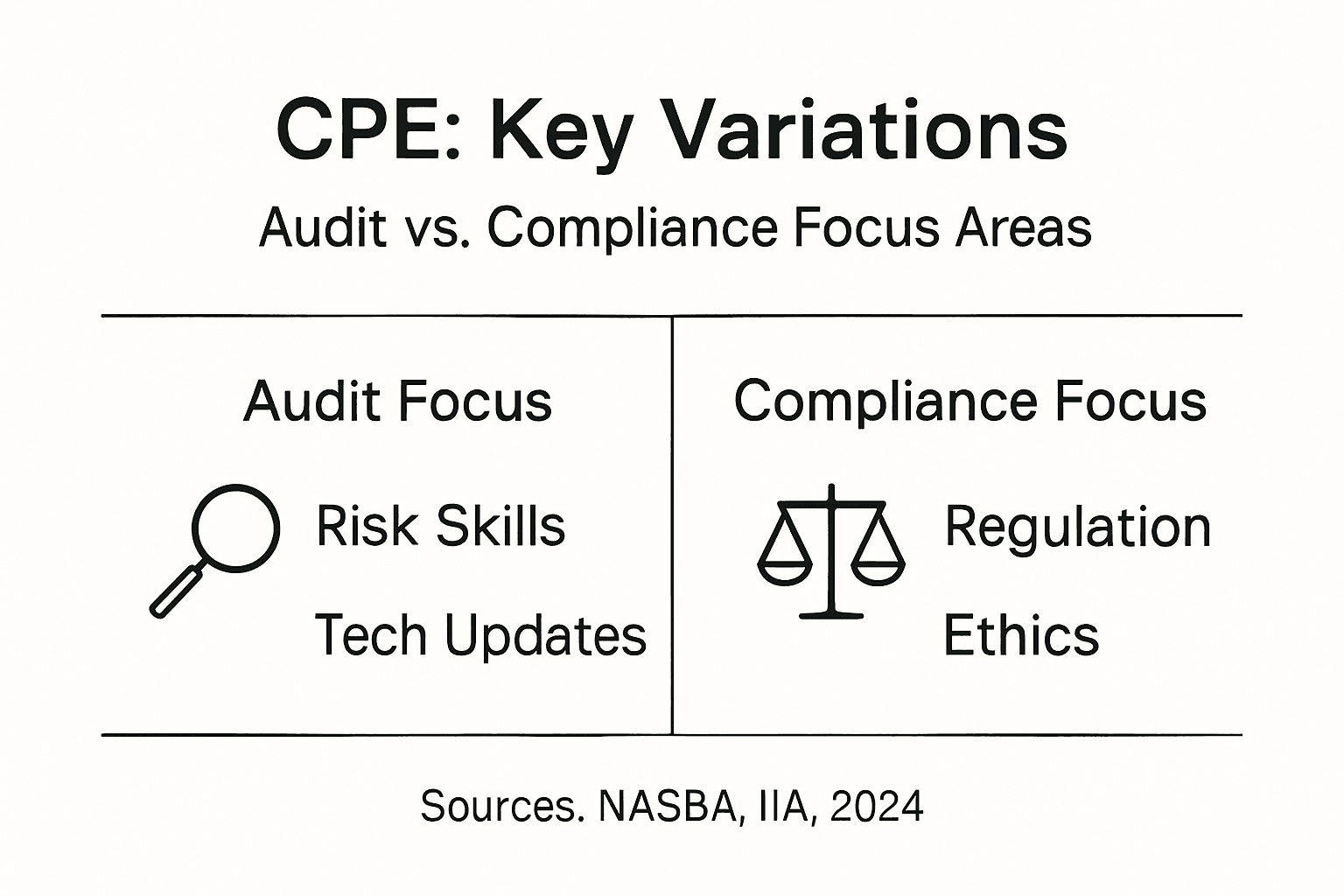

Key Variations in CPE for Audit and Compliance

Continuing Professional Education (CPE) requirements demonstrate significant variations across different audit and compliance professional tracks, reflecting the specialized nature of each field. Updated CPE standards now recognize the need for more flexible and targeted learning approaches tailored to specific professional domains.

For internal auditors, CPE often emphasizes risk management, control frameworks, and emerging technology integration. Certified Internal Auditors (CIAs) typically need to demonstrate proficiency in areas like cybersecurity, data analytics, and enterprise risk management. External auditors, particularly those working with public companies, have different requirements focused on financial reporting standards, PCAOB regulations, and advanced assurance techniques. Compliance professionals, meanwhile, require credits that cover regulatory changes, ethical standards, and industry-specific legal requirements.

The delivery methods for CPE have also evolved dramatically. While traditional in-person seminars remain important, virtual learning options now provide unprecedented flexibility. Professionals can now earn credits through interactive webinars, online courses, self-study modules, and even structured professional reading. These varied formats accommodate different learning styles and professional schedules, making continuous education more accessible than ever before.

This summary outlines common CPE delivery formats and their unique benefits:

Format | Description | Advantages |

In-person Seminar | Live group training and discussion | Networking, real-time feedback |

Webinar | Interactive online sessions | Flexibility, cost-effective |

Self-study Module | Individual online or print learning | Self-paced, topic depth |

Professional Reading | Structured study of key publications | Deep knowledge, current issues |

Pro tip: Develop a personalized CPE strategy that aligns with your specific career trajectory, focusing on credits that directly enhance your professional competencies and future advancement potential.

Here’s a comparison of CPE focus areas for major audit and compliance credentials:

Credential | Primary CPE Topics | Minimum Annual Credits |

CPA | Financial reporting, ethics, tax updates | 40 credits per year |

CIA | Internal controls, risk management, cybersecurity | 40 credits per year |

CFE | Fraud detection, ethics, investigation techniques | 20 credits per year |

CISA | IS auditing, IT governance, data analytics | 20 credits per year |

How CPE Supports Certifications and Professional Growth

Professional certifications represent significant investments in career development, and Continuing Professional Education (CPE) serves as the critical mechanism for maintaining and enhancing these valuable credentials. Professional development strategies ensure that certifications remain current, relevant, and aligned with rapidly evolving industry standards.

For audit and compliance professionals, CPE is not merely about maintaining a certification but represents a strategic pathway to career advancement. Each certification track requires specific learning objectives that demonstrate ongoing competence. Certified Internal Auditors (CIAs), Certified Public Accountants (CPAs), Certified Fraud Examiners (CFEs), and Certified Information Systems Auditors (CISAs) must complete targeted educational credits that validate their expertise in emerging technologies, regulatory changes, and advanced professional practices.

The structured nature of CPE goes beyond simple credit accumulation. Structured professional development pathways provide professionals with opportunities to specialize, gain advanced credentials, and demonstrate continuous learning commitment. By engaging in diverse learning experiences such as conferences, workshops, online courses, and professional reading, individuals can strategically build their knowledge base, expand their professional networks, and position themselves for higher-level roles and increased responsibilities.

Pro tip: Create an annual CPE learning plan that strategically maps your credits to both certification requirements and your specific career advancement goals.

Legal Standards and Industry Mandates for CPE

Continuing Professional Education (CPE) is governed by rigorous legal standards that ensure professionals maintain the highest levels of competence and public trust. CPE legal frameworks establish comprehensive requirements that professionals must meet to retain their professional credentials and practice legally.

For audit and compliance professionals, these legal mandates are particularly stringent. Regulatory bodies like the National Association of State Boards of Accountancy (NASBA) and the Public Company Accounting Oversight Board (PCAOB) dictate specific requirements for maintaining professional certifications. Certified Public Accountants (CPAs), Certified Internal Auditors (CIAs), and other credentialed professionals must complete a precise number of CPE credits annually, with strict guidelines about the types of learning activities that qualify. These requirements ensure that professionals stay current with evolving regulatory landscapes, technological advancements, and industry best practices.

The legal implications of CPE extend beyond simple credit accumulation. Professional registration standards directly tie ongoing education to the ability to practice. Failure to meet CPE requirements can result in professional sanctions, including suspension or revocation of professional licenses. This creates a powerful incentive for professionals to engage meaningfully with continuing education, treating it not as a bureaucratic requirement but as a critical component of professional responsibility and career development.

Pro tip: Maintain meticulous documentation of your CPE activities, including detailed records of courses, certificates, and learning outcomes, to protect your professional standing.

Risks of Neglecting Ongoing Professional Education

Professional development is not optional in today’s rapidly evolving workplace. Professional skill degradation represents a significant risk for audit and compliance professionals who fail to engage in continuous learning, potentially compromising their career trajectory and professional effectiveness.

The consequences of neglecting ongoing education extend far beyond simple knowledge gaps. Professionals who do not actively pursue continuing education face multiple critical risks. These include becoming technologically obsolete, losing competitive edge in job markets, and failing to understand emerging regulatory requirements. For audit and compliance specialists, staying current is particularly crucial, as regulatory landscapes continuously shift and technological advancements fundamentally transform risk assessment and control methodologies.

Career sustainability research demonstrates that professionals who do not invest in ongoing learning are more likely to experience decreased job performance, reduced employability, and increased vulnerability to professional burnout. In fields like internal auditing and compliance, where precision and up-to-date knowledge are paramount, falling behind can mean the difference between being a sought-after professional and becoming marginalized in the industry.

Pro tip: Create a quarterly professional development plan that proactively identifies emerging skills and knowledge areas critical to your specific career path.

Stay Ahead With Trusted Continuing Professional Education Solutions

The article highlights the urgent need for audit and compliance professionals to keep pace with evolving standards, technology, and regulations through structured Continuing Professional Education (CPE). Falling behind can risk your career, professional standing, and effectiveness in today’s demanding environments. Common challenges include managing complex certification requirements for CPA, CIA, CFE, and CISA credentials while ensuring learning activities align with rigorous legal standards and industry mandates.

Compliance-Seminars.com offers a comprehensive platform tailored precisely to these critical needs. With NASBA-recognized courses, live webinars, and in-person seminars taught by industry experts with Big 4 experience, you gain practical knowledge on financial reporting, cybersecurity frameworks, internal controls, and compliance topics essential for career growth. Our flexible learning options empower you to build a personalized CPE strategy that meets your certification demands and supports your professional advancement.

Ready to take control of your professional development before deadlines approach?

Explore our extensive course offerings now at Compliance Seminars and secure your path to continuous competence and career success. Don’t wait until compliance risks catch you off guard. Visit https://compliance-seminars.com and start your next CPE journey today.

Frequently Asked Questions

What is Continuing Professional Education (CPE)?

Continuing Professional Education (CPE) is a structured approach to lifelong learning that helps professionals maintain and enhance their skills throughout their careers by participating in various learning activities such as courses, workshops, and webinars.

Why is CPE important for maintaining professional certifications?

CPE is essential for maintaining professional certifications because it ensures that professionals stay current with industry standards, technological advancements, and regulatory changes, thereby demonstrating ongoing competence in their fields.

What are the different formats available for completing CPE credits?

CPE credits can be earned through various formats including in-person seminars, webinars, self-study modules, and professional reading. Each format offers unique benefits, such as networking opportunities or flexible scheduling.

What risks do professionals face by neglecting ongoing education?

Professionals who neglect ongoing education risk becoming technologically obsolete, losing competitive edge in their job markets, and failing to meet evolving regulatory requirements, which can negatively impact their job performance and career sustainability.

Recommended

Comments